workers comp taxes texas

For the most part you will not have to list workers compensation settlement money as income when filing your taxes. In General Workers Comp Settlements Are Not Taxable.

Opt Out Plans Let Companies Work Without Workers Comp Npr

Youll receive only a portion of your lost wages although it may help to learn that workers comp benefits are generally tax-free.

. In addition you cant receive any payment for the. Workers Compensation Texas Law. As you can see there are limits to workers comp benefits.

Is Workers Comp Tax. Subscribing to workers compensation insurance puts a limit on the amount and type of compensation that an injured employee may receive - the limits are set in. This is also true if you are the beneficiary of a payout after a loved one was killed in a workplace accident.

This is known as a workers compensation offset So if SSA reduces your monthly SSDI check by 200 due to the workers compensation offset then 200 of your workers comp will be taxable. However retirement plan benefits are taxable if either of these apply. Call 888-434-COMP 888-434-2667 and talk to our hard-working.

In most cases they wont pay taxes on workers comp benefits. A workers compensation attorney might suggest you spread out lump-sum payments or shift to Social Security retirement benefits to minimize the offset and avoid tax issues. You do not need to claim the income benefits from workers compensation you receive on your taxes.

Texas unlike other states does not require an employer to have workers compensation coverage. The Court found that the Plaintiff-Employee improperly joined a Co-Defendant-Employer that maintained workers compensation insurance in order to prevent complete diversity of the parties. Limitations of Workers Comp Benefits.

You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness. Workers compensation settlements are not taxable in Texas. To limit or dispute your medical care and your entitlement to income benefits.

Texas Workers Compensation laws are complex and impact many areas of an injured workers life and future. March 1 for the previous calendar year for licensed insurers writing workers compensation insurance for example March 1 2015 for policies written in. Similarly those who receive a workers compensation.

Benefits are available only. The quick answer is that generally workers compensation benefits are not taxable. Whether you have received weekly payments or a lump sum federal law does not allow it.

Regulate Texas workers compensation efficiently educate system participants and achieve a balanced system in which everyone is treated fairly with dignity and respect. The fifth component of your tax rate is the Employment and Training Investment Assessment ETIAThe assessment is imposed on each employer paying contributions under the Texas Unemployment Compensation Act as a separate assessment of 010 percent of wages paid by an employer. But as we noted most workers compensation claims are straightforward affairs.

It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury tendinitis or carpal tunnel. Vary each year as adopted by the Texas Department of Insurance. The benefits from workers compensation are typically not taxable in Texas.

You retire due to your occupational sickness. For instance welfare benefits and compensatory damages awarded for physical injury are not considered taxable income. The lone exception arises when an individual also receives disability benefits through Social Security disability insurance SSDI or Supplemental Security Income SSI.

But be careful because a confidentiality clause could make the settlement taxable. Consult with an experienced attorney before you sign a settlement agreement. Forms available for electronic filing are indicated by.

You do not need to claim the income benefits from workers compensation you receive on your taxes. Workers comp in texas requirements texas department of insurance workers comp workers comp insurance quotes online workers comp insurance in texas texas workers compensation insurance cheap workers comp insurance quotes texas workers comp insurance requirements workers comp insurance texas cost Coral LED lamps if so the multi-task task of significant. Requires all employers with or without workers compensation insurance coverage to comply with reporting and notification requirements under the Texas Workers Compensation Act.

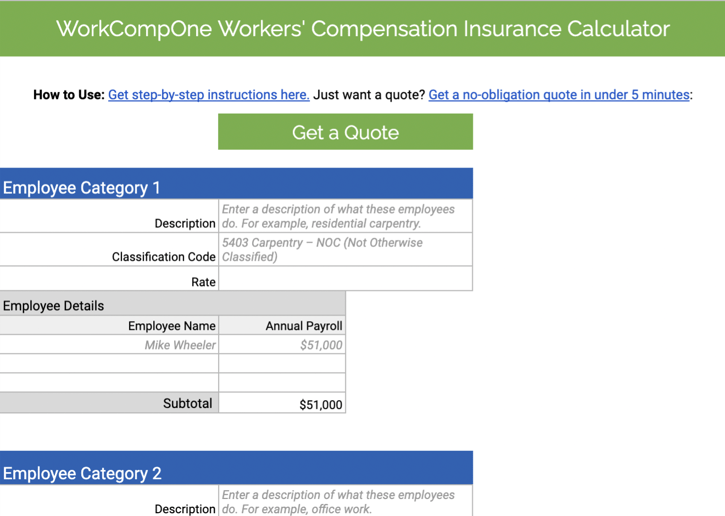

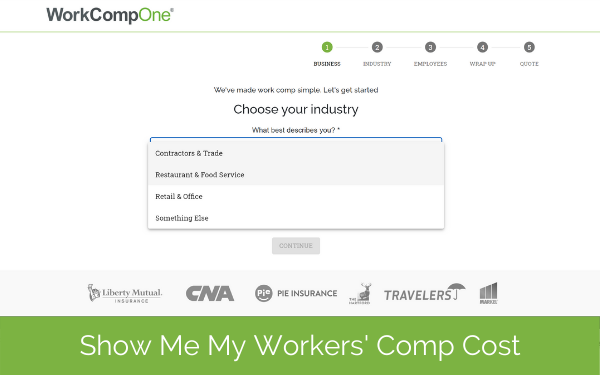

Refer to 28 TAC Rule 1414 and our publication Insurance Maintenance Tax Rates and Assessments on Premiums. IMPORTANT This workers comp payment calculator is simply a tool to. Per the IRS you are not required to pay tax on the funds you receive from your workers compensation settlement.

Is a Lump Sum Workers Comp Settlement Taxable. Workers compensation benefits are not normally considered taxable income at the state or federal level. We encourage you to speak with a financial professional to make sure that you follow all.

This is a complete listing of all Division of Workers Compensation Forms. In some cases the Social Security Administration SSA may reduce a persons SSDI or SSI so. Workers comp laws vary from state to state so it would pay to get legal advice in this situation.

Provides for reimbursement of medical expenses and a portion of lost wages due to a work-related injury disease or illness. Abbott and Associates LLC has provided this tool as a way of calculating an approximated amount of your Texas Workers Comp Income Benefits in the event that you suffer more than 7 days of lost time after a workers comp injury. The forms are also available in individual listings.

Texas law does not deem compensatory damages awarded for bodily. When filing taxes you do not need to add workers comp to your earned income. Workers compensation complete listing of forms.

Workers compensation benefits and settlements are fully tax-exempt which means you do not have to pay taxes. The Magistrate for the United States District Court Western District of Texas denied the Plaintiff-Employees motion to remand to state court. Workers comp will also pay up to 10000 for burial expenses.

The Texas Workforce Commission indicates that the effective tax rate in 2019 ranges from a minimum of 036 paid by 656 of employers to a maximum of 636 paid by 53 of employers for experienced-rated accounts and the average experience tax rate is 106. The benefits from workers compensation are typically not taxable in Texas. However there are some situations when this general rule does not apply.

Similarly workers comp settlements are generally not taxable and do not need to be claimed on your tax return. You will typically not have to pay taxes on a workers compensation settlement at the state or federal level in Texas. Calculate Your Texas Workers Comp Benefits.

Workers Compensation Research and Evaluation Group. See Electronic filing - online forms for more information about filing your PDF form online. The short answer is.

Do you claim workers comp on taxes the answer is no. Most income earned by Texas residents is taxable and so must be reported on their federal tax returns. The insurance carrier has one goal.

Do you pay taxes on workers comp in Texas. Any pension based on your age years of service etc. The nations best care and services for injured employees and their employers.

What Is Workers Compensation Article

Amazing Spinning Coin Trick Revealed Coin Tricks Magic Tricks Trick

Opt Out Plans Let Companies Work Without Workers Comp Npr

Texas Non Subscriber How Can Injured Worker S Get Compensation

Is Workers Comp Taxable Hourly Inc

Workers Compensation Insurance Requirements Costs More

Workers Compensation Insurance Cost Calculator How Much For A Small Business Policy

What Is Workers Compensation Article

How To Reduce Workers Compensation Insurance Costs Employers Resource

Taxable Benefits From Workers Compensation In Texas

Texas Workers Compensation Insurance Laws Forbes Advisor

What Is Workers Compensation Article

How To Calculate Workers Compensation Cost Per Employee

Pin By Tracy On My Politics 1 Labor Union Pro Union Social Activities

How Are Workers Compensation Benefits Calculated Foa Law

Is Workers Comp Taxable Hourly Inc

How To Calculate Workers Compensation Cost Per Employee